Table of Contents

The Impact of ETF Approvals on the Crypto Market in 2025

In 2025, the approval of crypto Exchange-Traded Funds (ETFs) could be the watershed moment for the crypto market. ETFs, particularly Bitcoin ETFs and Ethereum ETFs, are expected to act as bridges between traditional finance and the crypto space, inviting an influx of institutional and retail investments.

The approval of a Spot Ethereum ETF by the SEC, once it happens in 2025, will be monumental. It will provide institutional investors with a regulated, transparent vehicle for exposure to Ethereum without the complexities of direct crypto custody. Coinbase’s involvement in these ETFs might pave the way for the Ether $10K prediction to become a tangible reality. Since Coinbase investment strategies have historically been seen as a bellwether for institutional adoption, a move toward facilitating Ethereum ETFs could trigger a ripple effect across other major exchanges.

However, there’s more than just investor sentiment at play. ETF approvals might inadvertently increase market volatility. While ETFs will allow traditional investors to hedge, they could also amplify market swings. ETFs inherently tie a large amount of capital to the underlying asset, and if market dynamics become too aggressive, ETFs might accentuate Bitcoin’s volatility due to their leverage effect. The long-term effect on Bitcoin’s 2025 volatility could therefore be twofold: price upticks driven by new capital inflows, but also heightened risks of speculative bubbles driven by new ETF market mechanisms.

Moreover, the global macroeconomic environment could play a decisive role in the success or failure of crypto ETFs. In the case of global financial instability or tightening regulations, ETF markets could exacerbate price swings. Hence, while ETF approval is a major positive, it also introduces new layers of complexity for investors.

Bitcoin’s Continued Volatility and Its Role in 2025 Investment Strategies

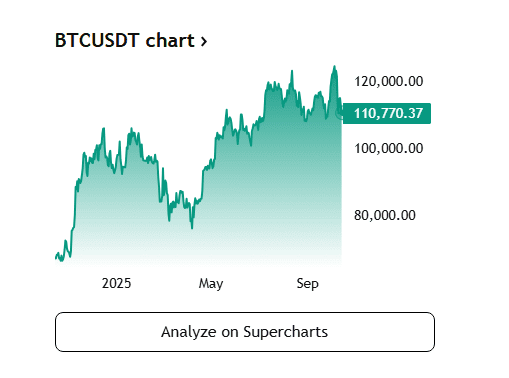

Bitcoin’s volatility is often viewed as both a curse and a blessing. As the crypto market matures in 2025, Bitcoin’s price could exhibit even higher levels of volatility due to external market forces, including macroeconomic events, evolving regulations, and technological innovations. However, volatility will also continue to attract traders and speculators looking to profit from Bitcoin’s unpredictable nature.

Bitcoin’s 2025 volatility will largely be influenced by broader economic shifts, including inflation, interest rates, and government intervention in the crypto space. For instance, if central banks continue to tighten monetary policy to combat inflation, Bitcoin could become a safe haven, driving demand and causing upward price swings. However, geopolitical tensions, such as trade wars or regional conflicts, could exacerbate Bitcoin’s price drops, leading to more volatile market corrections.

One strategy to mitigate Bitcoin’s volatility in 2025 is to adopt a hybrid investment model. Investors might consider IOTA Miner’s cloud mining contracts—a newly emerging investment tool designed to hedge against Bitcoin’s unpredictable swings. These contracts could provide an opportunity to earn a passive income from mining while offering more consistent returns than direct Bitcoin investments. Cloud mining contracts also shield investors from operational risks like hardware failure and maintenance costs, which are often an issue in traditional mining setups.

To further mitigate risk, investors will increasingly turn to blockchain analytics tools that provide real-time market insights. These tools can help track Bitcoin’s network activity and identify whale movements, potentially allowing investors to make more data-driven investment decisions to counteract volatility. In this environment, those leveraging a more diversified crypto portfolio (including altcoins) will have a better chance of outperforming market swings.

The Future of Crypto Treasuries and Market Consolidation

The evolution of crypto treasuries will be one of the most significant trends shaping the crypto market in 2025. Major corporations and hedge funds are increasingly moving toward diversified crypto holdings to hedge against inflationary pressures. These players are integrating crypto as part of their balance sheet strategies, leading to the consolidation of market power within the top-tier cryptocurrencies.

Ethereum’s transition to a deflationary model (often referred to as “Ultrasound Money”) will play a critical role in the future of crypto treasuries. With Ethereum’s transition to Proof-of-Stake and the EIP-1559 upgrade, a portion of transaction fees will be burned, reducing the overall supply. In the face of rising inflation, more institutional players will view Ethereum as a store of value, possibly rivaling gold in its status as a hedge against inflation. In this environment, Ethereum’s growth is poised to continue beyond its original use case as a smart contract platform, potentially outpacing Bitcoin’s dominance.

Meanwhile, the rise of DeFi platforms and centralized exchanges (CEX) will lead to more market consolidation. IOTA Miner’s cloud mining contracts could become a key player in this shift, enabling businesses to mine cryptocurrencies without having to operate expensive mining farms. This will allow businesses to maintain control of their crypto treasuries while reducing mining overhead costs and gaining exposure to a broader range of digital assets.

By 2025, large-scale consolidation will also reduce the number of competitive altcoins in the market. We will likely see a smaller set of high-cap coins (Bitcoin, Ethereum, and a few others) dominate the crypto treasury landscape, as institutional players prefer established assets that can hedge against risks like market manipulation or high gas fees.

Ethereum’s Transition to Deflationary Models and the ‘Ultrasound Money’ Narrative

Ethereum’s transition to a deflationary asset through EIP-1559 and Proof-of-Stake is likely to have a profound impact on its valuation and adoption by both retail and institutional investors. The concept of “Ultrasound Money”—Ethereum’s ongoing supply reduction via transaction fee burns—is positioned to make it a long-term store of value, enhancing its appeal as an inflation hedge.

In 2025, this transition will continue to attract institutional players, particularly those who see Ethereum as a long-term store of value. As Ethereum’s market cap rises, Coinbase’s investment strategies might begin focusing more heavily on Ethereum-based financial products like ETFs, further driving up Ether’s price. Analysts are already projecting that Ether could hit $10,000 by the end of the decade if the current trends in DeFi and NFT adoption continue to grow.

The Ultrasound Money narrative will evolve alongside Ethereum’s technological updates, particularly after the Ethereum 2.0 upgrade is fully realized. Ethereum’s ability to scale and handle thousands of transactions per second will solidify its position as a global settlement layer for digital assets. Consequently, Ethereum may see greater integration into traditional financial markets and become an asset on the balance sheets of institutional treasuries.

How the SEC’s Exploration of Blockchain for Stock Trading Could Shape the Future

The SEC’s exploration of blockchain for stock trading in 2025 is poised to reshape the future of both traditional finance and the crypto space. As the SEC increases its focus on blockchain technology, it could lead to more transparent, secure, and efficient trading platforms. For crypto, this is significant because it could pave the way for regulated platforms that facilitate spot trading and the direct purchase of cryptocurrencies in the stock markets.

The approval of the Spot Ethereum ETF would further legitimize blockchain assets within the traditional financial system. In turn, this could unlock a massive influx of capital from traditional investors, especially those working within established financial institutions. The SEC’s approval could create a more secure investment environment, which might lead to an increase in the top 5 trending crypto coins in the USA by 2025.

Additionally, the SEC’s decision to allow more blockchain-based platforms to list crypto assets could catalyze the development of new financial products like tokenized stocks. These products could become an attractive vehicle for large institutional investors to gain exposure to cryptocurrencies while maintaining the regulatory protections afforded by traditional financial markets.

The Rise of New Crypto Coins and Their Potential in 2025

New cryptocurrencies will emerge in 2025, driven by technological innovations, use case diversity, and solving scalability issues. While Bitcoin and Ethereum will continue to dominate, altcoins will start gaining more traction as they address specific market needs like faster transaction speeds, low fees, and environmental sustainability.

One key trend to watch in 2025 will be the rise of NFT-focused blockchains, which will see increasing demand from artists, creators, and content platforms. The ability of these new coins to tokenize real-world assets could revolutionize industries like real estate, art, and intellectual property, creating new market verticals that could make these altcoins more relevant than ever before.

While Ethereum continues to evolve, the IOTA Miner’s cloud mining contracts could provide significant opportunities for businesses and individuals looking to capitalize on the growing ecosystem of these emerging niche coins.

Best Crypto Wallets for Beginners’ Security: What You Need to Know in 2025

Security remains a top priority for crypto investors, particularly for beginners in 2025. With the rise in cybercrime targeting crypto holders, it’s crucial to choose a wallet that offers top-tier security features.

Hardware wallets (like Ledger and Trezor) will continue to dominate as the safest option for long-term storage. These wallets provide an offline storage solution, making them immune to hacking attempts. For beginners, multi-factor authentication (MFA) will become standard in most wallets, adding an extra layer of protection against potential breaches.

By 2025, wallet providers will also integrate educational resources to help newcomers navigate the complexities of the crypto world. Cold storage options and custodial wallets will become the norm for those seeking to protect their assets while also minimizing risk exposure.

To protect against these threats, newcomers must consult a guide on the best crypto wallets for beginners’ security to ensure proper cold storage setup

The Next Phase: Why Market Sophistication is the Key to Success in 2025

As we look toward 2025, the Crypto Market Roadmap points to a landscape of increased regulation, evolving financial products, and more institutional involvement. The next five years will see key players like Ethereum, Bitcoin, and emerging technologies lead the way in transforming both traditional and digital finance. By adopting a more strategic, diversified investment approach, you can better position yourself for success in this rapidly evolving market.

Iqra Zahoor is a Financial Journalist and Crypto Market Analyst with a Bachelor’s Degree. She specializes in translating complex blockchain developments and market volatility into actionable, unbiased intelligence. Iqra is committed to rigorous research, ensuring readers receive only the most reliable and timely insights into the digital asset space.